Blog

2018 Property Predictions – Are you ready? posted on the 23rd January 2018

A new year brings opportunities for all in the ever-changing property market – maybe this is the year for you to snag yourself a great investment bargain or make a nice profit through a smart renovation. Whatever your plans for 2018, you need to know what type of property to buy and which area you should buy in… and more importantly, which ones to avoid!

Property “bloodbath” in 2018: unit warning issued

High-rise apartments under construction in Brisbane. Picture: Marc Robertson.

Elizabeth Tilley, Fraser Coast Chronicle

2nd Jan 2018

BRISBANE’S oversupplied apartment market and parts of southeast Queensland’s housing sector are headed for a “bloodbath” in 2018, according to one property commentator.

Buyer’s agent and former valuer Anna Porter, principal of Suburbanite, has some blunt advice for unit investment holders in Brisbane – get out now.

“Steer completely clear of units,” she said.

“They’re incredibly oversupplied and there will be a bloodbath in the unit market over the next couple of years.

“Lending will tighten, values will retract and rent will be hard to maintain.”

One property commentator warns Brisbane’s unit market is headed for a “bloodbath”. Photo: Adam Armstrong.

The latest Urbis apartment report revealed 300 new units were sold in Brisbane in the September quarter of 2017, with the average sale price dropping more than $80,000.

Another 7100 apartments are expected to reach settlement in 2018.

Urbis property economics and research director Paul Riga said Brisbane apartments were still selling, even in the current market conditions.

“Established local developers with a reputation for quality product and strong networks are achieving great results,” he said.

“For the rest of the market, it is certainly harder than it was 18 months ago but sales continue to tick over quarter after quarter.”

Urbis property economics and research director Paul Riga.

But Ms Porter is not just concerned about the Brisbane unit market.

“Down the southeast pocket of Queensland, towards Logan and Ipswich, we’re going to start to see some pain I think towards the end of 2018,” Ms Porter said.

“We’re starting to see the local council cracking on a lot of the granny flats being illegally rented. A lot of people have purchased these properties with the idea of getting a dual income, but this is being stripped away from them.

“There is also a little bit of pressure on interest rates, and vacancy rates are creeping up.”

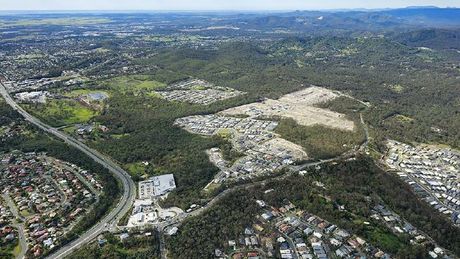

A house-and-land development in Logan, Queensland.

Ms Porter said there was also a lot of new stock coming to the market in the form of house and land packages.

“This is starting to push a huge amount of supply into the market,” she said.

Ms Porter predicts consistent growth for Brisbane house prices in the year ahead, with renovated houses likely to continue to sell well.

“A tip for young players – renovate in Brisbane,” she said.

“Renovated properties in Brisbane sell a lot better. Add value and you will see an uptick.”

Property commentator predicts steady growth for Brisbane house prices.

Need a helping hand or some friendly advice

before investing in 2018?