Blog

Residency Interests, Features and Rights for Granny Flats posted on the 25th February 2014

Have you ever wondered from a pension or government allowance point of view just what the criteria is? We have attached the following for your information (www.humanservices.gov.au) 22 May 2014 :

The term granny flat right or interest is a description of an agreement for accommodation and not a description of the type of dwelling you live in or rent.

A granny flat right or interest is created when you pay for a life interest or right to accommodation for life, and the life interest or right to accommodation for life is in a private residence that is to be your principal home.

Homes that can be granny flats

A granny flat is usually a separate, self contained building or living area attached to a home or property. Dual occupancy allows the construction of a detached dwelling on a large block where a residence already exists. However a granny flat interest can be created in any kind of dwelling and not just those typically referred to as granny flats. You cannot have a granny flat right or life interest in a property in which you have legal ownership.

We recognize that granny flats are usually family arrangements providing company and nearby help and support for older people. This is not required for a living arrangement to be considered a granny flat for social security purposes.

Whether you live alone, with the owner or in a separate self-contained dwelling on someone else’s property, your home will meet the granny flat requirements and can be assessed under special rules if:

- It is all or part of a private residence

- It is not owned by you, your partner, or a trust or company that you control, and

- You have established a granny flat interest

Granny flat interest

You establish a granny flat interest when you exchange assets or money for a right to live in someone else’s property for as long as you live. For example:

- You transfer ownership of your home but retain a right to live there or in another private property for the rest of your life, or

- You transfer assets, including money, for a right to live in a private property for the rest of your life

There are 2 ways to have a lifetime right to live in a property that you do not own – a life tenancy and a life interest. A life tenancy just gives you the right to live in the property. A life interest gives you the right to use and benefit from the property as you wish. Both ways meet the requirement of a granny flat right or interest provided you are living there

Your granny flat right or interest cannot be revoked because the owner wishes to sell the property. They may :

- Sell the property with your arrangement as a condition of sale

- Transfer your life tenancy or interest to another property, or

- Compensate you financially for losing your granny flat interest

Although we may accept that you have a granny flat interest, even if it is not in writing, we recommend that you have a legal document drawn up by a solicitor to give evidence of the arrangement. This should help to prevent any problems in the future if your personal circumstances change. The document should :

- Confirm you have security of tenure

- State whether you are liable for any upkeep of the property or payment of rent, and

- Outline how you are to be compensated if the property owner cannot maintain your life interest

A granny flat right or interest only exists during your lifetime and is not part of your estate.

You should contact us to see if any of these actions would reduce your payments.

How we assess your granny flat interest

We need to know what you transferred to the property owner in exchange for a granny flat right or interest. We use this to work out if you deprived yourself of assets by paying too much and assess whether you are a homeowner or a non-homeowner.

We do not use a market value to assess the worth of a granny flat interest. Instead, it is considered to be worth the value of the assets you transferred or paid if you :

- You transfer the title of the home you live in to someone else and keep a lifetime right to live in that home or in another home. This applies if your home or would have been totally exempt from the asset test

- Pay the costs associated to build a granny flat on someone else’s property or the costs to convert someone else’s property to suit your needs and established a lifetime right to live there

- Buy a property in someone else’s name and establish a lifetime right to reside there

Provided you pay in 1 of these ways and do not transfer additional assets as well, no deprivation will occur.

If you transfer assets in addition to the above we apply the reasonableness test. This includes the transfer of a home property, part of which would have been assessable.

The Reasonableness Test

If the amount you paid or the value of the property you transferred is more than the value of the granny flat interest, the excess is considered to be a deprived asset. This could affect the amount of pension you are paid.

The reasonableness test is used to determine if you are considered to have deprived yourself of assets when establishing a granny flat right or interest. The amount of the combined partnered rate of annual pension, regardless of whether you are single or partnered, is multiplied by the age related factor. If you are partnered the age of the younger member of the couple is used.

Age related factor

If you are assessed as a home owner

We may still consider you to be a home owner for assessment purposes even though you do not own the property in which you have your granny flat interest. Your home owner status determines :

- if the amount you paid is an asset

- which asset test threshold is applied before it affects your rate of payment, and

- if you might be entitled to Rent Assistance

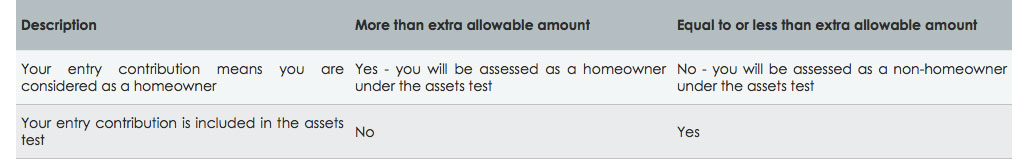

A non-home owner has a higher asset test threshold than a home owner. The difference between the thresholds is called the extra allowable amount. This amount is compared to your entry contribution.

If you were not assessed under the reasonableness test your entry contribution is the amount you actually paid.

If you were assessed under the reasonableness test, your entry contribution is :

- the value of the granny flat interest, if you were assessed as paying more than the reasonableness test amount, or

- the amount you actually paid if you were assessed as paying less than your reasonableness test amount

How your entry contribution affects your entitlement

If you leave the home that you have a granny flat interest in

If you stop living in the home within 5 years, we will review the granny flat interest. If the reason for leaving could have been anticipated at the time the interest was created, then deprivation rules also known as gifting will apply.

The deprivation rules will apply if you permanently leave the home for the remainder of the 5 years from the creation of the granny flat interest. They do not apply if you are temporarily absent from the home for up to 12 months. If you temporarily leave due to loss or damage to the home, this period may be extended for up to 2 years.

Read more about disposing of your granny flat and gifting.

http://www.humanservices.gov.au/customer/enablers/assets/granny-flats

Written by Sonia Woolley